Both cash and the value of prizes are considered “other income” on your Form 1040.If you score big, you might even receive a Form W-2G reporting your winnings. The tax code requires institutions that offer gambling to issue Forms W-2G if you win. $600 or more on a horse race (if the win pays at least 300 times the wager amount). Whether it's $5 or $5,000, from an office pool or from a casino, all gambling winnings must be reported on your tax return as 'other income' on Schedule 1 (Form 1040), line 21. If you win a non. For information on withholding on gambling winnings, refer to Publication 505, Tax Withholding and Estimated Tax.' Can I Deduct Losses?: You can deduct your gambling losses if you itemize on a Form 1040 Schedule A. You have to track all your losses and winnings and report them comprehensively, and you can only deduct up to the amount of.

There’s lots of fun games to play for free here at Agame.com. Gamers of all ages will enjoy our huge collection of puzzle games, action games, and more. In these free online games, you can do everything from collecting precious gems to contending with malfunctioning robots in a pizza parlor. If that last one sounds familiar, you may have already played Five Nights at Freddy’s, but it’s not one of our kids. Play thousands of free online games: arcade games, puzzle games, funny games, sports games, shooting games, and more. New free games every day at AddictingGames. Any fun games to play online.

More Articles

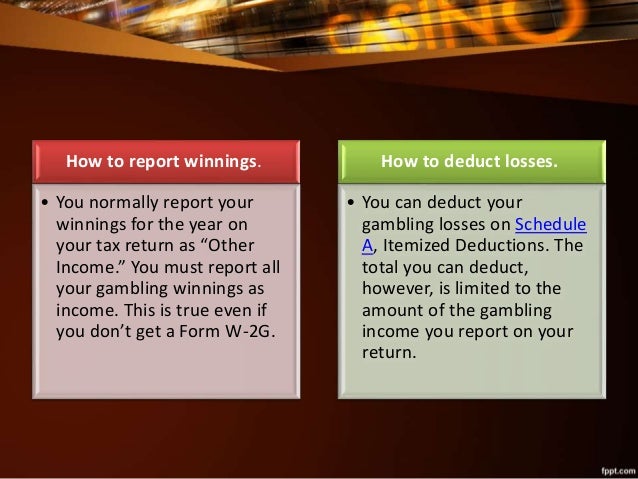

If you had a successful night at the slots or poker tables, you're going to have to share some of the lucky proceeds with Uncle Sam. The Internal Revenue Service generally requires that you report your gambling winnings and losses separately when you file your taxes rather than combining the two amounts.

Record Keeping

:max_bytes(150000):strip_icc()/GettyImages-1148165783-23ec8b9cf3314f21b91d1acbc6db0783.jpg)

As you gamble during the year, you need to keep records of your winnings and losses so that you can support whatever figures you report on your taxes. The IRS permits you to use per-session recording, which means that instead of recording whether you won or lost each time you pull the slot machine, you can simply record your total for the session. Your records should include the date and type of gambling, where you gambled and if you gambled with anyone else, such as a home poker game. If you win more than $600, you should receive a Form W-2G from the casino.

Taxable Winnings

When figuring your gambling winnings, only include the winnings from each session rather than using losses to offset your gains. You have to include gambling winnings even if you didn't receive a Form W-2G from the casino. For example, if you gambled six times during the year, winning $100, $3,000, $4,000 and $6,000 but losing $5,000 and $2,000, your gambling winnings for the year are $13,100. This amount gets reported on line 21 of your Form 1040 tax return.

Gambling Losses

To claim your gambling losses, you have to itemize your deductions. Gambling losses are a miscellaneous deduction, but -- unlike some other miscellaneous deductions -- you can deduct the entire loss. The deduction goes on line 28 of Schedule A and you have to note that the deduction is for gambling losses. Money storm casino no deposit. For example, if you lost $5,000 on one occasion and $7,000 on another, your total deduction is $12,000.

That's because this particular online casino takes all players from practically everywhere in the world! Right now, you can try out for free by taking advantage of our Exclusive $50 No Deposit Bonus Code Extreme50 which is instantly credited during your registration that you can use to play all of their great games! They are powered by Real Time Gaming software and they have tons of great games and offers to choose from; including blackjack, slots, video poker, and more! Top rated online slots for real money no deposit usa. Visit now and get your free no deposit bonus!Whenever one of our website visitors asks us to recommend an online casino to them, we never hesitate to recommend. To make it even better for you, your first deposit gets rewarded with 2 times the amount.

Gambling Loss Limitation

You can't deduct more in gambling losses than you have in gambling winnings for the year. For example, suppose you reported $13,000 in gambling winnings on Line 21 of Form 1040. Even if you lost $100,000 that year, your gambling loss deduction is limited to $13,000. Worse, you aren't allowed to carry forward the excess, so if you had $87,000 in losses you couldn't deduct last year, you can't use that to offset the gambling income from the current year.

Video of the Day

References (2)

Photo Credits

- tax forms image by Chad McDermott from Fotolia.com

About the Author

Tax Form For Gambling Loss

Based in the Kansas City area, Mike specializes in personal finance and business topics. He has been writing since 2009 and has been published by 'Quicken,' 'TurboTax,' and 'The Motley Fool.'